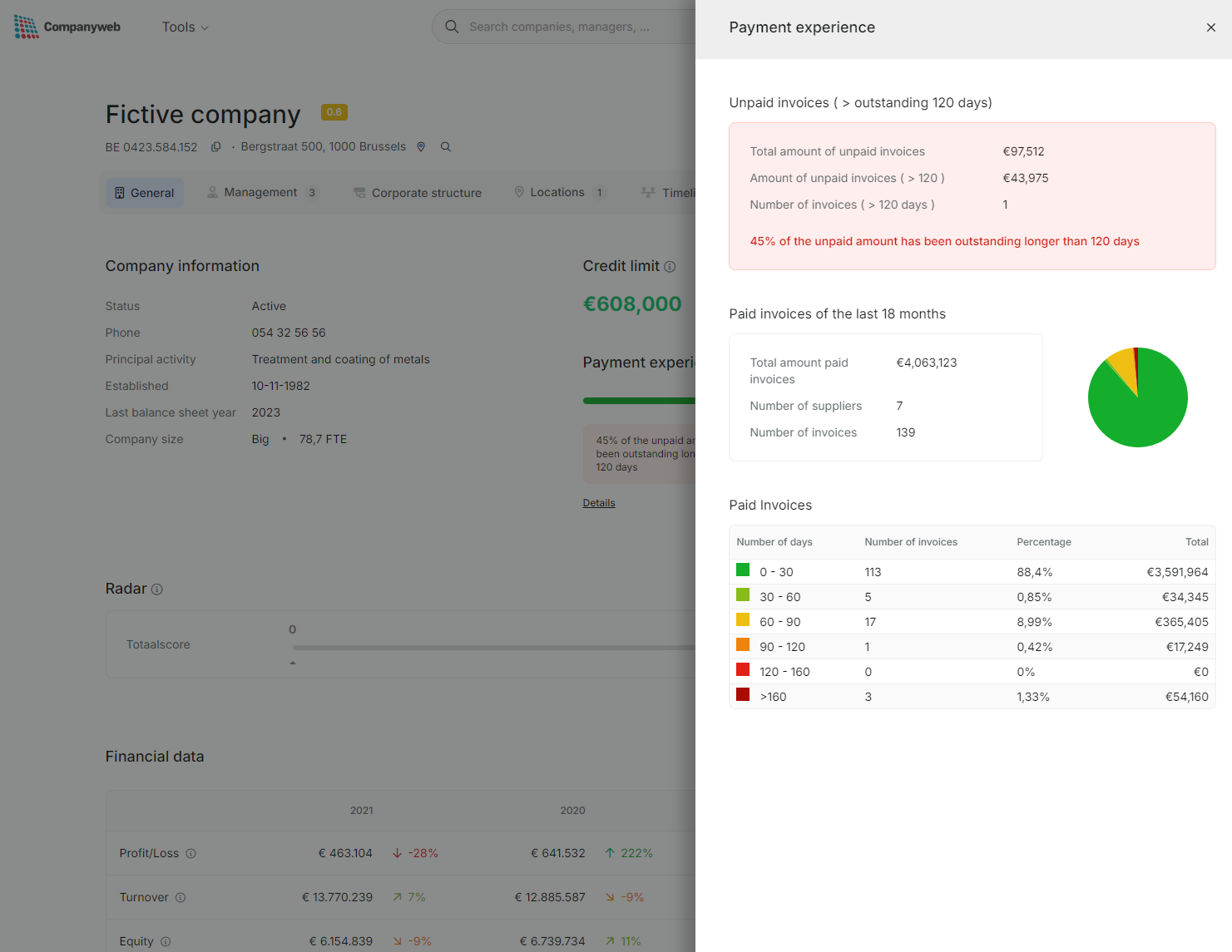

Payment experience

What is payment experience?

Do you also find following up on bad payers such a tedious and time-consuming task? Detect them in advance with the free "Payment experience" module. This shows you how quickly a company pays its invoices. You'll know if a customer or prospect is a bad payer and can consciously choose not to enter into a contract or apply stricter payment terms.

How to participate?

To use the Payment Experience feature, you must have a Companyweb subscription. Curious about what more Companyweb has to offer? Start a free trial and get started right away.

Try for freeYour benefits

- You know in advance how well your customer or prospect is paying

- You see how fast customers pay at other suppliers

- Simple but powerful visual overview

- No prior knowledge required

- Free module

What does payment experience look like?

On the detail page of every company, the Payment Experience bar is located under the Credit Limit. When clicking on "View details", the summary of how well the company pays their invoices will be displayed.